With the cooler temps, what better time to get together for community activities? There is much to do during the spring and fall months, no matter where you live. Let us talk about some fun events HOA Boards could offer in your community this fall and, most importantly, how to execute them effectively!

Successful HOA events all come down to planning. The more you plan, the better your event will be executed. Below is a checklist or guide of items you can do before your event to ensure success.

HOA Event Planning Tips

Choosing a date/time

When choosing an event date and time, it’s essential to avoid scheduling multiple events on the same day or time. Also, be sure to check your local events, such as those in your city, state, and neighboring communities. It may not always be possible to avoid planning events on the same day as others, but try to avoid scheduling “like” events on the same day. For example, if your city has a Fun Run, don’t schedule a community Fun Run around the same time.

Know your Association

Know your Association. What exactly do we mean by that? If you plan an event in a multi-generational community, there are better options than weekdays or weeknights during the school year. Family communities offer events on Friday evenings or the weekends to maximize attendance. If your community is for Active Adults (55+), do most of your residents still work? If so, then weekday or weeknight events may also not be ideal. However, if your association comprises a majority of retired residents, you may have more flexibility when offering events. Knowing your community can ensure the most attendance at your events.

Know your budget

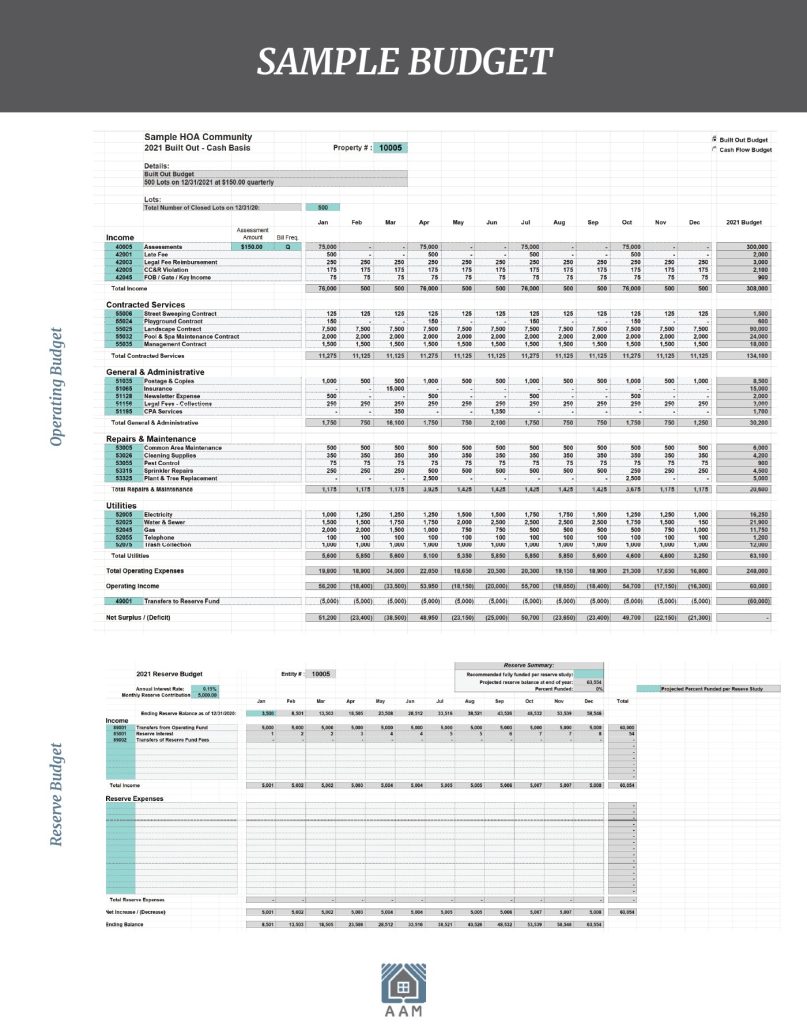

Defining and sticking to your budget is crucial for planning successful events by reducing the stress of going over budget and having to cut corners to make the event happen. Knowing your budget for each event will ensure a successful year of events!

Booking your vendors for HOA events

Be sure to do your due diligence when choosing your vendors, whether a band, a caterer, or a performer. Please do your homework, get referrals, check YouTube videos, or call a colleague who may have used them. Knowing what you are getting upfront will help you have a successful event.

Building your team

Build your team! Putting on a successful HOA event is not a one-person job and requires a team. Every team needs a leader and support behind them. So, whether your team is supporting staff or volunteers, be sure to equip them with the necessary tools. Timelines and job assignments with detailed information will help your team support you in being effective. Plan accordingly with team meetings leading up to your event, and always have a post-event meeting. There is always room for improvement, so post-event discussions are an excellent tool for continuing to plan successful events.

Promoting your event

Utilize your team to promote your events. It is crucial to ensure that event details are adequately promoted. Create flyers, announce them in community newsletters, send emails, add them to your website, and mention them at Board meetings. The more ways you can inform the members of your HOA, the more successful your event will be.

Event Ideas

Food & Drink Gatherings

Low-cost, high turnout—sharing food always brings people together.

- Neighborhood Potluck

Invite everyone to bring a dish and taste the diversity of the community. - DIY Chili Cook-Off

Friendly competition where residents show off their best chili recipes. - Ice Cream Meet-Up

A sunny-day favorite with build-your-own sundaes. - Breakfast-for-Dinner Night

Serve comfort food with pancakes and eggs at dinnertime! - Wine & Cheese Social

A classy evening for residents to mingle and sample pairings. - Food Truck Night

Partner with local trucks and bring dinner right to your block.

Seasonal Celebrations & Themed Parties

Recurring events that establish tradition and community pride.

- Community Park Bash

Music, lawn games, and food trucks or grills—an annual Summer/Spring hit. - Winter Hot Cocoa Gathering

Set up a cocoa station and fire pit for a cozy winter social. - Holiday Cookie Exchange

Invite neighbors to bring their best baked goods and swap treats. - Costume Party or Trunk-or-Treat

Halloween fun for all ages—either dress up or swap old costumes for new ones.

Mind & Body Activities

Build connections while promoting health and personal growth.

- Yoga in the Park

Invite a local instructor or follow a guided video together. - Trivia Night

Friendly, low-cost competition that gets people talking. - Paint & Sip

Unleash creativity over wine or mocktails with a guided painting night. - Book Swap or Club

Start a mini library or organize monthly discussions.

Creative & DIY Event

Appeal to hands-on hobbyists and families alike.

- Neighborhood Craft Day

Provide simple supplies or invite residents to lead mini projects. - Holiday Décor Workshop

Create wreaths, ornaments, or centerpieces together before the season starts. - Community Art Show

Invite local artists and kids to showcase their work in a gallery-style display.

Family-Friendly Fun

Inclusive events that bring out kids, parents, and grandparents.

- Outdoor Movie Night

Use a projector and show a family film on the lawn. - Scavenger Hunt

Engaging and straightforward, with teams exploring the neighborhood. - Pet Parade

Let furry friends shine in a walk-around event with prizes or themes. - Camp Out Night

Pitch tents in a shared space for s’mores, ghost stories, and bonding.

Community Service

Events that create pride and a sense of shared responsibility.

- Neighborhood Clean-Up Day

Provide gloves, bags, and refreshments—watch people show up. - Community Garden Launch

Designate a space for flowers or veggies and let residents get digging. - Charity Drive or Volunteer Day

Support a local food bank or shelter together—big heart, low cost.

HOA events can be a lot of work, but they can certainly help build a stronger sense of community and increase overall resident satisfaction. Events are also a good time to activate homeowner participation by creating a Social Committee to help the Board plan and execute community events. Learn more about Building HOA Committees. Use this information provided to get inspired, organized, and ready to implement successful events for years to come.

When it comes to helping Boards and residents get the most out of their HOA, AAM is here to help. Communities under our care benefit from the direct support of a lifestyle team that serves as AAM’s global resource for community events and lifestyle programming. The team is also responsible for ensuring that all programs, services, and events are conducted and fulfilled in a manner consistent with the community’s goals and objectives and remain compliant with local, state, and federal regulations.